Ray Dalio released his unconventional template on how the economy works in 2013 which it is still relevant today. We can study this template to understand where we are today in relation to where we have been.

Dalio recently has explained we are right now (as of September 2018) towards the end of the short term debt cycle (business cycle) after having enjoyed a beautiful deleveraging and expansion after the debt crisis of 2008 (long term debt cycle.

Below is a written summary of his template, but you can watch the entire video here:

Though the economy might seem complex, it works in a simple mechanical way, it’s made up of a few simple parts and a lot of simple transactions that are repeated over and over again a zillion times. These transactions above all else are driven by human nature and they create three main forces that drive the economy.

Number one, productivity growth.

Number two, the short term debt cycle.

And number three the long term debt cycle.

An economy is simply the sum of the transactions that make it up and a transaction is a very simple thing. You make transactions all the time. Every time you buy something, you create a transaction. Each transaction consists of a buyer exchanging money or credit with a seller for goods, services, or financial assets.

Credit spends just like money, so adding together the money spent and the amount of credit spent, you could know the total spending. The total amount of spending drives the economy. If you divide the amounts spent by the quantity sold, you get the price and that’s it, that’s a transaction. It’s the building block of the economic machine.

All cycles and all forces in an economy are driven by transactions. So, if we can understand transactions, we can understand the whole economy. A market consists of all the buyers and all the sellers making all transactions for the same thing. For example, there is a (wheat) market, a farm market, a stock market and markets from millions of things. An economy consists of all of the transactions and all of its markets. If you add up the total spending and the total quantity sold in all of the markets, you have everything you need to know to understand the economy.

The biggest buyer and seller is the government which consists of two important parts. A central government that collects taxes and spends money and a central bank, which is different from other buyers and sellers because it controls the amount of money and credit in the economy, it does this by influencing interest rates and printing new money.

Credit is the most important part of the economy and probably the least understood. It’s the most important part because it’s the biggest and most volatile part. Just like buyers and sellers go to the market to make transactions, so the lenders and borrowers. Lenders usually want to make their money into more money and borrowers usually want to buy something they can afford, like a house or a car, or they want to invest in something like starting a business. Credit can help both lenders and borrowers get what they want. Borrowers promise to pay the amount they borrow called principal, plus an additional amount called interest.

When interest rates are low, borrowing increases because it’s cheaper. When borrowers promise to repay and lenders believe them, credit is created. Any two people can agree to create credit out of thin air, that seems simple enough but credit is tricky because it has different names, as soon as credit is created, it immediately turns into debt. Debt is both an asset to the lender and a liability to the borrower. In the future, when the borrower repays the loan plus interest, the asset and the liability disappear and the transaction is settled. So why is credit so important? Because when a borrower receives credit, he is able to increase his spending, and remember, spending drives the economy.

This is because one persons spending is another person’s income. Think about it, every dollar you spend, someone else earns and every dollar you earn, someone else’s spend. So when you spend more, someone else earns more. When someone’s income rises, it makes lenders more willing to lend them more money because now he’s more worthy of credit. A credit worthy borrower has two things, the ability to repay and collateral.

Having a lot of income in relation to his debt, gives him the ability to repay. In the event that he can’t repay, he has valuable assets to use as collateral that can be sold. This makes lenders feel comfortable lending him money. So increased income, allows increase borrowing, which allows increase spending and since one person’s spending is another person’s income, this leads to more increase borrowing and so on. This self free enforcing pattern leads to economic growth and it’s why we have cycles.

Debt swings occur in two big cycles. One takes about five to eight years and the other takes about 75 to a hundred years, while most people feel the swings, they typically don’t see them as cycles because they see them too up close, day by day, week by week.

The reality is, that most of what people call money is actually credit.

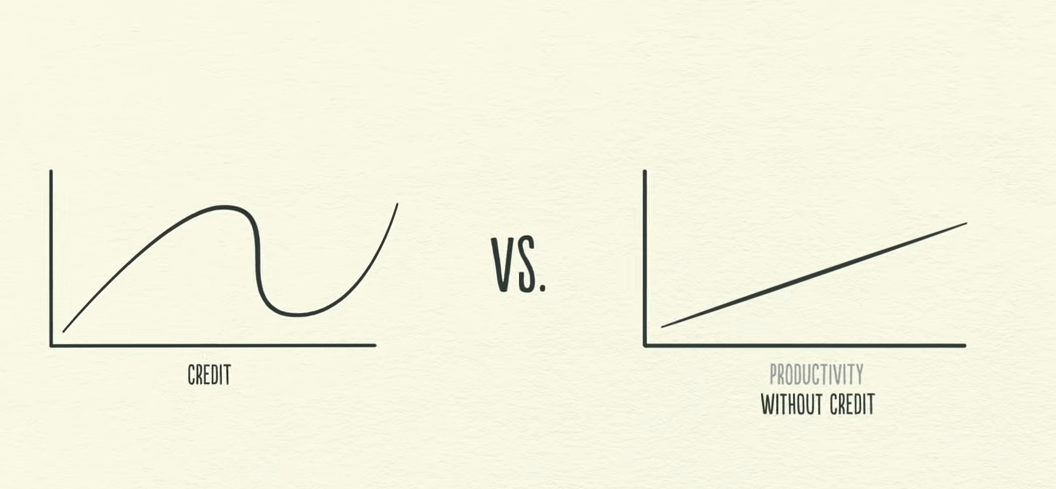

In an economy without credit the only way to increase your spending is to produce more, but with an economy with credit, you can also increase your spending by borrowing. As a result, an economy with credit has more spending and allows incomes to rise faster than productivity over the short run but not over the long run.

Credit isn’t necessarily something bad but just causes cycles. It’s bad when it finances over a consumption that can’t be paid back, however it’s good when it efficiently allocates resources and produces income, so you can pay back the debt.

When the amount of spending and income grow faster than the production of goods, prices rise, when prices rise, we call this inflation.

Seeing prices rise, the central bank raises interest rates. With higher interest rates, fewer people can afford to borrow money and the cost of existing debts rises.

Because people borrow less and a higher debt repayments, they have less money left over to spend, so spending slows. And since one person’s spending is another person’s income, incomes drop and so on and so forth. When people spend less, prices go down, we call this deflation. Economic activity decreases and we have a recession. If the recession becomes too severe and inflation is no longer a problem, the central bank will lower interest rates to cause everything to pick up again.

As you can see, the economy works like a machine. In the short term debt cycles, spending is constrained only by the willingness of lenders and borrowers to provide and receive credit.

When credit is easily available, there is an economic expansion. When credit isn’t easily available, there is a recession and note that this cycle is controlled primarily by the central bank.

Over decades, debt burdens slowly increase creating larger and larger debt repayments. At some point, debt repayments start growing faster than incomes, forcing people to cut back on their spending. And since one person’s spending is another person’s income, incomes begin to go down, which makes people less credit worthy, causing borrowing to go down. Debt repayments continue to rise, which makes spending drop even further and the cycle reverses itself. This is the long term debt peak, debt burden have simply become too big.

Now the economy begins deleveraging. In a deleveraging, people cuts spending, incomes fall, credit disappears, asset prices drop, banks gets squeezed, the stock market crashes, social tensions rise and the whole thing starts to feed on itself the other way.

Scrambling to fill this hole, borrowers are forced to sell assets. The rush to sell assets floods the market at the same time as spending falls. This is when the stock market collapses, the real estate market tanks and banks get into trouble. As asset prices drop, the value of the collateral borrowers can put up drops, this makes borrowers even less credit worthy, people feel poor, credit rapidly disappears. Less spending, less income, less wealth, less credit, less borrowing, and so on, it’s a vicious cycle.

This appears similar to a recession but the difference here is that interest rates can’t be lowered to save the day. In a recession, lowering interest rates works to stimulate borrowing, however in deleveraging, lowering interest rates doesn’t work because interest rates are already low and soon hits zero percent, so the stimulation ends. Interest rates in the United States hits zero percent during deleveraging of the 1930’s and again, in 2008. The difference between a recession and a deleveraging is that in the deleveraging, borrowers debt burdens have simply gotten too big and can’t be relieved by lowering interest rates.

This severe economic contraction is a depression, a big part of a depression is people discovering much of what they’ve thought was their wealth isn’t really there.

This situation can lead to political change that can sometimes be extreme. In the 1930’s, this led to Hitler come into power, war in Europe and depression in the United States, pressure to do something to end the depression increases. Remember, most of what people thought was money was actually credit.

So when credit disappears, people don’t have enough money. People are desperate for money and you remember who can print money, the central bank can. Having already lowered already its interest rates to nearly zero, it’s forced to print money. Unlike cut in spending, debt reduction and wealth redistribution, printing money is inflationary and stimulative. Inevitably, the central bank prints new money out of thin air and uses it to buy financial assets and government bonds.

It happened in the United States during the great depression and again in 2008, when the United States central bank, the federal reserve printed over two trillion dollars. Other central banks around the world that could, printed a lot of money too.

This is a very risky time. Policy makers need to balance the four ways that debt burdens come down. The deflationary ways need to balance with the inflationary ways in order to maintain stability. If balanced correctly, there can be a beautiful deleveraging. You see, a deleveraging could be ugly or it can be beautiful. How can be a deleveraging be beautiful? Even though a deleveraging is a difficult situation, handling a difficult situation in the best possible way is beautiful.

In a beautiful deleveraging, debts decline relative to income, real economic growth is positive and inflation isn’t a problem. It is achieved by having the right balance, the right balance requires a certain mix of cut in spending, reducing debt, transferring wealth and printing money, so that economic and social stability can be maintained. People ask if printing money will raise inflation, it won’t if it offsets falling credit. Remember, spending is what matters. A dollar of spending paid for with money has the same effect on price as a dollar spending paid for with credit. By printing money, the central bank can make up for the disappearance of credit with an increase in the amount of money.

You need to print enough money to get the rate of income growth above the rate of interest. However, printing money could easily be abused because it’s so easy to do and people prefer to the alternatives. The key is to avoid printing too much money and causing unacceptably high inflation the way Germany did during it’s deleveraging in the 1920’s. If policy makers achieve the right balance, a deleveraging isn’t so dramatic, growth is slow but debt burdens go down, that’s a beautiful deleveraging.

When incomes begin to rise, borrowers begin to appear more credit worthy, and when borrowers appear more credit worthy, lenders begin to lend money again. Debt burdens finally begin to fall, able to borrow money, people can spend more, eventually the economy begins to grow again, leading to the reflation phase of the long term debt cycle though the deleveraging process can be horrible if handled badly. If handled well, it will eventually fix the problem. It takes roughly a decade or more to debt burdens to fall and economic activity to get back to normal, hence the term lost decade enclosing.

So, in summary there are three rules of thumb that I’d like you to take away from this.

First, don’t have debt rise faster than income because your debt burdens will eventually crush you.

Second, don’t have income rise faster than productivity because you’ll eventually become uncompetitive.

And third, do all that you can to raise your productivity because in the long run, that’s what matters most.

This is simple advice for you and its simple advice for policy makers. You might be surprised, but most people including most policy makers don’t enough attention to this.

Leave a comment